IBM’s vestigial hardware business – 15.5% of Q4 company revenue – continues to slide. This won’t end well.

In its Q4/2013 earnings call, IBM’s profits were higher than forecast, but revenues were lower. Hardware was the major culprit.

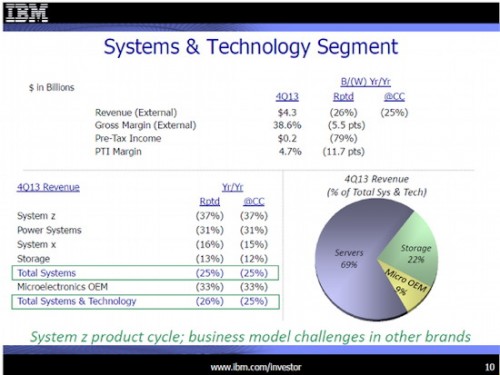

Total Systems and Technology segment sales were down 26% and profits were down 79% year over year. They don’t break out server shares, but the System x – as in x86 – business that they sold to Lenovo was down only 16% compared to mainframes – down 37% – and Power Systems – down 31%.

Storage did the best, declining only 13% to about $950 million. I’d expect their margins to be good – ≈60% – unlike the low-end server business. Here’s the slide from their Q4 call:

Margin drives all

IBM’s margin concerns led to the sale of x86 business, just as earlier concerns over disk, enclosure and printer margins led to those sales. We’re seeing a long, slow, going out of the-hardware-business sale.

But why would an almost $1B multi-billion dollar business with good margins fail? Because there is a meandering spiral towards a hardware exit, like water down the drain in slow motion.

Storage sales dynamics

Every system company has endless internal debates over the relationship between server and storage sales. “Your storage wouldn’t sell without out servers!”

“Yes, but we make the margins that keep us in business and the products that make your server a system!” The arguments continue because they’re both right.

IBM is no longer a hardware company, but software and services. With the low-end server business gone – which I expect counts for a lot of dollars – even fewer IBM reps are going to care about hardware.

The guys who sell mainframes – System z – are in a world of their own. They’re servicing the legacy apps that fly beneath the radar these days because the action is elsewhere. Those systems – and storage – are cash cows, even if they aren’t generating much cash relative to IBM’s size.

As I noted last May:

IBM‘s storage business is at risk. While they have great technology, none of their hardware products are even a strong #2. . . .

IBM top management is not sentimental. Given the disposal of once-core assets, such as disk drives, and IBM’s shrinking storage market share, it is clear that IBM will likely sell off or shutter some hardware product lines to focus on higher-margin storage. The Texas Memory Systems solid state arrays, storage software and mainframe storage are likely safe.

But at some point – and that point will come sooner rather than later due to the cloud’s competitive pressure – IBM’s management will decide that the overhead and investment required to support 3rd place and worse products isn’t worth it.

The StorageMojo take

As cloud storage and radical new products continue to punish traditional storage products, more customers will look beyond their server vendor for storage. With no market leading hardware, the IBM sales force will focus on defending – not expanding – market share.

That leads to a low-investment strategy reduces sales force mindshare and shrinking storage sales. Which leads to less investment.

Its clear that several traditional vendors will leave the general enterprise storage business over the next decade. IBM will be one.

Courteous comments welcome, of course. It still amazes me that after decades of storage leadership, IBM fumbled in the 90’s.

There’s some level of irony here, I think. You mention how IBM is selling off hardware businesses one-by-one, and also how EMC killed IBM in the storage market. Yet, wasn’t it EMC that picked up CLARiiON from Data General, which was likewise spinning off its hardware businesses one-by-one?

I find it fascinating how one company can thrive off the product line another throws away. Maybe Lenovo will enjoy success with the x86 server business? It looks like IBM was the first mainstream manufacturer to bring the flash-on-DIMM technology to market with their X6 series. If Lenovo can take hardware which has a (arguably well-deserved) reputation of high quality gear and support at a high price and keep only the quality and support ingredients of that recipe, they may have a winner.

Ryan,

System vendors spend a lot of energy fighting about the revenue split and engineering budgets between servers and storage. Storage companies don’t – and their sales force is more focussed as well. Plus, foolish system vendors like HP and Dell invited EMC into all their accounts, giving up account control and high storage margins in return for nothing. EMC was laughing all the way to the bank!

Lenovo will do well, I’m sure. They have economies of scale and are organized to handle low-margin business.

Robin

IBM storage has always been a by-product of the compute and application sales. You dont see thier storage in a non-IBM account. Now the have sold the low end server business they will be left punting only top end tech, such as TMS based flash kit, into high end compute environments. So not only will they naturally concede revenue in the mid-market, they are also allowing their storage competitors to eat in the markets they once were a part of. Their competitirs will thrive off this, growing in size, strength and execution, while IBM struggles to innovate. This is exactly the downward spiral you refer to.

Robin,

You are spot on. IBM will leave the hardware business completely, it’s only a matter of time. I also agree with Bruce that IBM does not see much storage business in non IBM accounts – it is rare.

Funny how you wrote this article. I was thinking the exact same thing.

http://www.reliant-technology.com/storage_blog/ibm-sells-servers-to-lenovo-is-storage-next

To the nay-sayers: IBM is a slow beast but historically has taken smart decisions, ending up the only player in history being an A-brand that is still alive and ‘kicking’. Splitting their laptop business to Lenovo was a very smart choice. It hasn’t hurt IBM as such and it did well under Lenovo.

I can imagine the x86 going the same route under Lenovo as the server business is actively shifting from the A-vendors to the low margin manufacturers (Super Micro / Quanta).

The storage business could go the same route. As everything (a lot) is shifting to a software model (SDS) it’s up to the smart A-brands to take advantage of this as soon as possible. The hardware appliances of tomorrow could very well end up being the mainframes of today and the sooner IBM makes the right decision here, the better chance they will still be around in 30 years.

It is going to be interesting to watch storage subsumed by the hypervisor in the next few years. IMHO of the newcomers with significant mindshare today Simplivity has the most forward looking approach: FPGA on a dedicated card for actually ‘touching’ all those ones and zeroes.

I would guess that somewhere there is a lab full of bright folks working on an ASIC/FPGA card for all the data plane storage tasks done today by an ASIC on 3PAR/HDS etc. today, but the control plane is a hypervisor service. Same for networking.

Robin your analysis is right on. IBM like other compute and storage companies have not been able to get over their organizational structures to effectively drive the compute-storage businesses. Newer technologies like PCIe flash in servers is a good example of this built-in conflict who owns the this storage story? At EMC and other there is no fight.

That IBM has been on a long transition to a software and service company is no surprise to anyone but to see them loss so much ground in the storage market which has historically been a very good margin business (as in software) is reminiscent of the Detroit auto companies losing market to the foreign imports.

There are always companies that can run profitability what others can’t.

Interesting comments and views. I lived through the 90s and the IBM loss to EMC, fascinating how IBM stood still at that time.

Heard some interesting news the other day, IBM has full on plans to kill AIX. It is on a 10 year path to 0. Smart move, not smart move, who am I to say. I hold a special place for IBM given their history, NASA etc. Sad to watch such a historical institution morph.

Just came across your article. As an insider, I agree with you article, but I’m not sure how that equals IBM storage being dead. You mention that FlashSystem (TMS), mainframe storage (DS8) and software defined are safe… that is 90% of IBM storage. IBM has already dropped LSI rebrand and NetApp rebrand. What are the products you are thinking of, if not the ones mentioned as safe, which are on the chopping block? The only two not mentioned are the V line (SVC with disk) and XIV. Those two products are essentially software today. IBM markets these products as great software with completely undifferentiated commodity hardware. I think it is clear IBM wants to make storage a software business.

I think the storage company that is really in trouble is NetApp. They are ground zero for cloud attacks, file sharing being a natural for cloud.