When my children were little and cried due to a scraped knee, I would examine it gravely and then say: “This looks bad! Time to amputate!”

That quieted them right down and, to my relief, they’ve grown up to be functional human beings working – of all things – in high tech.

But that was a joke. With IBM storage I wouldn’t be joking.

Amputation is imminent. And needed to keep shareholders happy.

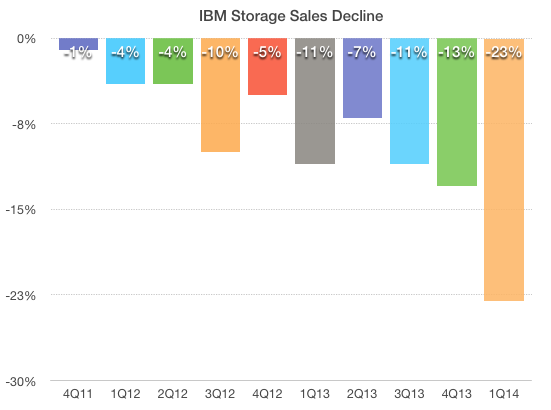

According to Storage Newsletter, IBM storage revenue is in an accelerating slide:

The StorageMojo take

My, that looks grim. But why?

The sale of the IBM’s server business was a wake up call to dyed-blue customers that their usual buying choices weren’t going to look too good at the next annual review. So they started looking elsewhere. As did IBM sales.

In the short term good for EMC – who seems to be sweeping up most of the lost market share of the 7 dwarves – but in the longer term even better for upstarts like Nimble, Nutanix and Coho Data who offer modern architectures and strong value props.

With the low-end server business gone, management’s spotlight falls on storage. As StorageMojo noted a year ago:

IBM‘s storage business is at risk. While they have great technology, none of their hardware products are even a strong #2. Two thirds of IBM’s Systems and Technology group business is servers, and it is clear that IBM management isn’t happy with how some product lines are performing.

They’re less happy today.

Courteous comments welcome, of course. And to think that 20 years ago IBM dominated the storage industry.

Robin, I’m not going to comment on your content but I’d make a few points for you to consider……

Storage prices have been coming down for years, good for our clients and good for the market.

IBM is investing heavily in Storage, it’s clear to me with the purchases over the last few years, the key purchase in my opinion being Texas Memory Systems.

Spinning disk will decline and Flash products are growing…

In my view, IBM has the best products in the Flash marketplace…. These are robust and clients are buying, by the dozen.

IBM has transformed its storage portfolio to one which is virtually all designed and built by IBM. This brings lots of advantages to the Company.

IBM’s storage software portfolio is comprehensive. It’s important to look at the whole portfolio for storage not just hardware.

How many banks do you know that want to put their data in the hands of a new kid on the block… Not my bank thank goodness.

I think you’ll see flash integrate more into systems… More reason to grow and invest than divest. I expect data to be brought closer to the systems…

The Lenovo agreement that has been made includes re-sale of IBM storage through Lenovo. This will bring new markets and a new channel for IBM storage.

Just some personal views, not those of IBM corp.

Sean Flanagan, IBM Systems Technology Group, Technical Sales Director, UK & Ireland.

Maybe this is just naive and a gross oversimplification on my part, but this seems perhaps like a Blockbuster/Netflix type problem–if IBM was making huge margins on large, traditional arrays and the market has moved on to effective–but much cheaper–solutions, is the answer automatically “sell,” simply because the new pie is smaller? Even though you’re still eating both?

Put another way… would IBM be happy if they sold only, say Nimble (assuming they owned Nimble)? I’m just guessing, but presumably the numbers and trend wouldn’t look good against their past heyday. But is it bad business? Are past numbers relevant in a changing market? Apples and oranges perhaps, but Blockbuster’s sales numbers would have tanked if they had adopted the Netflix business model early, yet they’d probably be growing now instead of dead.

IBM is the only player who’s been around for over a century, so we’ve become used to their business patterns by now. They get into new industries when their preferred markets (large-enterprise customers) start wanting to buy them, and they get out of industries when they become a commodity and a few years ahead of the margins plummeting.

Old-style storage hardware is becoming a commodity. I’m expecting to see IBM find a buyer for their old hardware lines, much like they’ve ditched laptop and server hardware. At the same time I’m expecting to see them ramp up in things like flash and “application” storage (distributed key/value stores, etc).

And maybe, just maybe, they’ll finally get that magnetic memory technology to the market.

I find it hysterical, that such a comment could be made by the IBM Guy. If IBM is spending BILLIONS on storage where is it going?

Once upon a time I was an IBMer, and once upon a time IBM mattered. Once VMware came along and LINUX became good enough to KILL UNIX, IBM lost its value, market share, and customers. The reason…their INTEL product was over engineered, over priced and prone to failure for simple compatibility issues the Dell, AND HP never had.

I love IBM POWER, but LINUX on Power, never flew, and never will.

With regards to Data Storage, IBM has had more catastrophic failures in the last decade…driven by late to the party products and the MEE TOO I WILL OEM U strategy, and when it does attempt to innovate or integrate the results are FRANKENSTEIN like products like the V7000.

Even the darling Flash product is so problematic that the 820 is

withdrawn…and the 840 arrives DOA.

IBM STORAGE IS A SINKING SHIP THAT IS RUSHING BAD

PRODUCTS TO MARKET AND RISKING CUSTOMER’S DATA.

Big name hardware manufacturers no longer offer value added over the generic and homemade offerings, just look at Amazon, Google, Facebook, Backblaze and most of the huge “hardware devourers”, all going the homemade/generic way.

This is clear sign that customers, resellers and consultants are looking for ways to avoid being tied to manufacturers and their abusive practices.