IDC’s Worldwide Total Disk Storage Systems Market for Q3 2015 had some interesting results. The thumbnail is the title of this post.

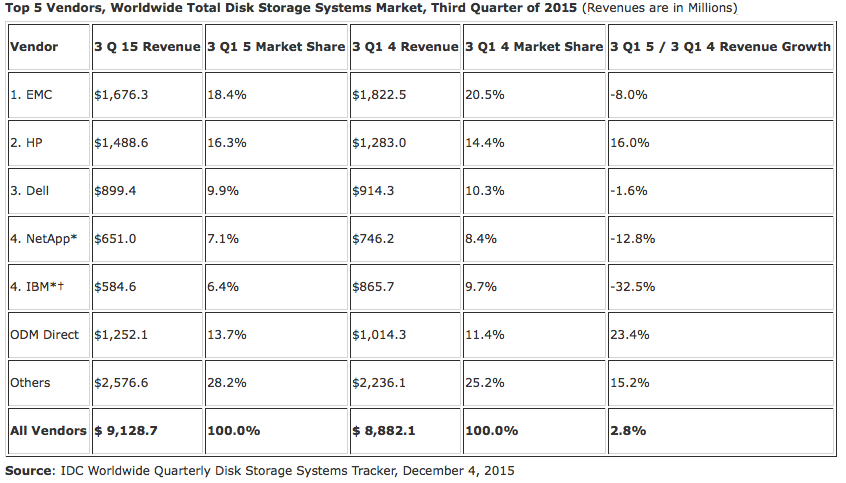

But there are a couple more details. ODM vendors – who sell direct to the hyperscale data center customers – had the fastest revenue growth of any supplier at 23.4%. HP’s revenue growth came in second at 16%, while the Others followed closely at 15.2%.

That’s where the growth stopped. EMC was down 8%. Dell down 1.6%. NetApp down 12.8%. And IBM, whose results reflected their sale of the x86 server business to Lenovo, was down 32.5%.

HP turning the corner

HP’s bold bet on 3PAR – which StorageMojo discussed in mid-2014, seems to be paying off. EMC’s disjointed product line – and NetApp’s tired one – aren’t competitive.

Beyond percentages

The most telling IDC number though is the absolute dollars. Out of a $9.1B revenue quarter, fully $3.8B went to Others and ODMs. That’s over 41% of the WW revenue.

Here’s the table from the IDC press release:

The StorageMojo take

It is now clear that modern storage architectures – the Others and HP – are taking share. The reluctance of EMC and NetApp to cannibalize their aged product lines is hitting them where it hurts.

But they are fighting back, as Nimble CEO Suresh Vasudevan recently noted in discussing their recent shortfall:

I would say in our competitive engagements pricing action by the large vendors is by far the most dominant factor that impacted us.

Deep discounts by legacy vendors are slowing down the Others. But that’s a tactic, not a strategy.

Legacy vendors are caught in a market vise between efficient modern architectures and low-cost hyperscale cloud providers. The jaws are closing and it isn’t likely that DSSD (EMC) or SolidFire (NetApp) will be enough to save either one.

Based on his actions, EMC’s Tucci doesn’t believe EMC has a future as an independent company. If NetApp’s board thought about it they’d see that the same is true of NetApp.

Once upon a time Boston’s Route 128 had a thriving flock of minicomputer makers. But the advent of the PC and its enormous volumes made commodity servers ever more competitive and one by one the minicomputer makers failed. A similar dynamic is overtaking the legacy storage vendors.

Courteous comments welcome, of course.

It is sad to see the way NetApp has gone. Back in the 1990s they were one of the reasons why I thought computer science was so interesting and practical — it is amazing to see something go from cutting edge to legacy that fast.