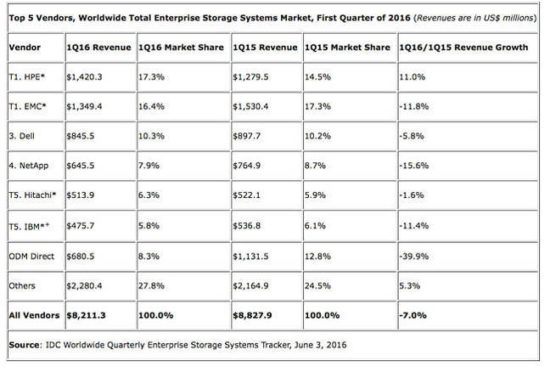

Some interesting numbers out of IDC by way of Chris Mellor of the Reg. First up: the entire enterprise storage market in the latest quarter:

Note that HPE is #1.

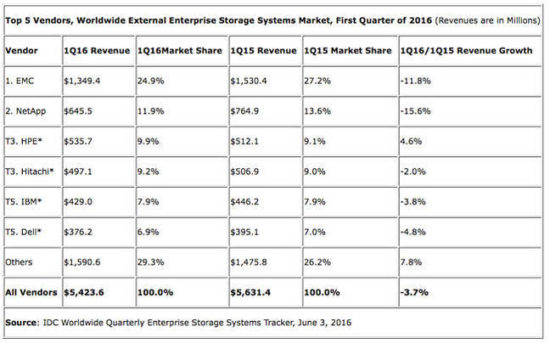

Then the numbers for the external enterprise storage market:

HPE is now #3 with $535.7 million.

The difference is internal storage

That means that HPE sold $884.6 million in internal enterprise storage. Dell is a similar story: $845.5M total; $376.2M external; $469.3M in internal storage. Hitachi and IBM both sell servers and enterprise storage, but their numbers are mostly external.

Among all vendors: $8211.3M total; $5423.6M external; $2787.7M internal.

HPE was the only vendor to show sales growth in both the total and external market. And most of there growth was in the internal market.

The StorageMojo take

Is the internalization of enterprise storage a trend? Yep.

Look at the growth of hyper-converged storage. The growth in servers that are, essentially, big boxes of drives. The growth in scale-out object storage that uses those big boxes of drives.

That puts a different complexion on the Dell/EMC combo. By itself EMC can’t compete for internal enterprise storage. By itself Dell can’t compete for the external enterprise storage market.

Together they can beat HPE. Which, five years ago, would have been laughably unambitious. Today, a worthy goal.

I was a guest at HPE’s Discover 2016 in Las Vegas a couple of weeks ago. One of their storage execs mentioned that internal storage was becoming a major part of their enterprise story. That struck me as odd until I thought about it – and saw the IDC numbers.

This is a natural outgrowth of treating storage components as devices that will fail, and asking the software to handle failures when they occur. That paradigm shift enables the use of commodity hardware – and internal storage. And more headwinds for the external storage vendors.

Courteous comments welcome, of course. I have a soft spot for HPE storage: DEC’s storage group and the StorageWorks brand were eventually absorbed into HP, and I was, among other things, the product manager for DEC’s first StorageWorks product.

As some of these big players (i.e. IBM) begin to push their Hybrid Cloud vision with both on-premise and public/private Cloud offerings managed under a single framework (i.e. Bluemix), I imagine the internal enterprise storage revenue numbers will continue to sky rocket.

Petros,

If I’m not mistaken IBM’s Softlayer cloud is based on SuperMicro servers. I’m curious if ODM or “Other” is the category that registers this. this also makes their growth numbers look like they are going down, as customers moving from an on premise V7000 to something software defined (VMware Virtual SAN, IBM spectrum etc) running on Softlayer is going to look like IBM revenue loss by IDC’s numbers (Despite IBM likely increasing revenues over time as they transition to opex hybrid cloud services).

John,

You are absolutely correct. It is almost entirely SuperMicro, although IBM has been able to wedge a couple of Power units in there. I am not sure how those fit the model.

I understand where you are coming from. Those are some interesting points you bring up. I wonder if the revenues reported are limited to just their Storwize offerings or if it expands to include their SDS (and enterprise storage other offerings). The original IDC report is a bit vague with its results.